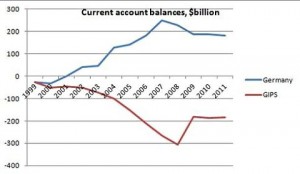

So, even as half of Europe is tanking economically — record unemployment, huge debt problems, interest rates spiraling — German is suffering from the lowest unemployment rate in 20 years. At a certain point, I think it is becoming increasingly apparent that the problems in Europe are not about “bad”, lazy, overspending countries threatening to bring down the EU and euro. Rather, the euro is fundamentally out of balance, and Germany has spent the last decade gaining from the inflated “currencies” of the PIIGS. As Paul Krugman recently graphed:

I quite like the spirit of Edward Hugh’s post here, saying one possible solution to the euro problem would be to divide Europe basically in half, with one euro (call it Euro1) for Germany, Finland, Holland and Austria, and another euro (Euro2) for the rest — and France could go either way. That way, the countries that need devaluation would devalue all together, then get move on the rebuilding their economies, rather than try to endure the long, horrid process of internal devaluing.

Of course, that would be a very problematic and only temporary measure — but at least it would give Europe time to come to grips with the fact that if you want a monetary union, you also have to have a stronger fiscal union. It might also give the Germans time to get off their high horse and realize how much they have been benefiting for the past decade from the sweat of their neighbors.

Leave a Reply